According to recent news, the Indian Rupee has taken a hit against the US Dollar. On May 17 it hit a fresh all-time intraday low at 77. 69. Usually, this currency appreciation or depreciation is calculated against the US Dollar. In layman’s terms, the value of rupees has decreased against the dollar.

In fact, the depreciation of the Indian Rupee is at such a pitiful state that it is being speculated to be at 79. 5 by the end of September 2022.

Therefore, in order to import goods from the USA or to purchase something, the common man has to pay a lot more than what they usually did.

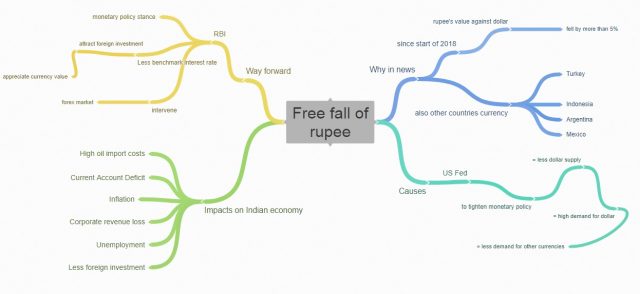

Why Did The Rupee Hit An All-Time Low?

A Surge in the US Treasury Yields

For starters, the returns of the bonds in the US treasury have increased by a significant amount. This entails that the government bonds in the USA which have a tenure of 10-year bonds or 25-year bonds have shown a distinct growth in terms of the return value.

In layman’s terms, people are willing to invest in the USA market which is leading to the crash of the Indian stock market.

Stock Market Crash of India

For a long time, the Foreign Institutional Investors (FII) who have been majorly running our stock market, have been pulling out their money and investing in the USA owing to the lack of returns from the Indian stock market and the significant amount of rising in the yield of the USA stock market. It is the FIIs’ investment in the Indian stock market that regulates our Sensex and Nifty.

Russian Invasion of Ukraine

With the Russian Invasion of Ukraine and a decrease in the foreign reserves, the war has managed to disrupt India’s edible oil market as the country imports more than 90% of its sunflower oil from Russia and Ukraine combined.

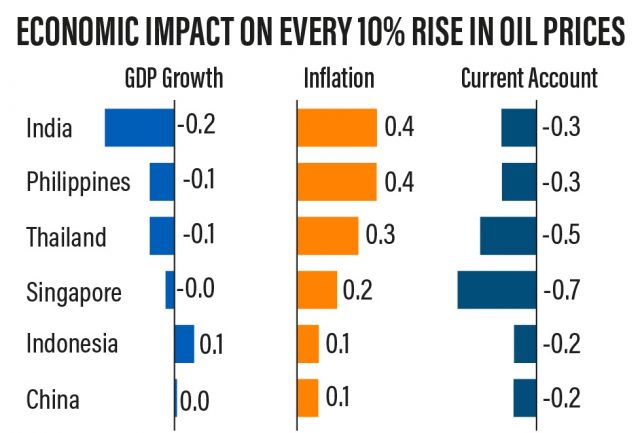

The price of crude oil has increased by 20% globally which entails an increase in the overall cost of production which leads to the fall of profit margins and reduces the stock price hence, causing inflation and stunting economic growth.

Read More: History Of How Rupee Has Fallen Over The Years From 4 Per Dollar To The Record 70 Per Dollar Today

Inflation and Stunted Economic Growth

It is only obvious that if there is a rise in the price of crude oil then it’ll create a domino effect leading to inflation.

The cost of petrol and diesel, increases which leads to a surge in transportation costs which entails an increase in the price of almost every commodity. Apart from these, there is also a massive surge in the cost of edible oils, coal, gas, etc.

According to a report by Business Standard,

“An impact of 22 billion dollars might be directly borne by Indian households. Companies will face an impact of about 23 billion dollars, the bulk of which might also be transferred to households. The increase in commodity prices will have a direct impact on the economy as India imports 85 percent of its oil requirements.”

How Will The Fall Of The Rupee Affect The Common Man?

For starters, the fall of the rupee will have a huge impact on students studying abroad as they will have to shell out more rupees if they have to buy dollars from the bank.

Necessary commodities like fuel, daily household items, electronics like mobiles, laptops, etc, household electricals, and solar plates will see a surge in price making it difficult to afford.

According to an analyst,

“Auto, real estate, and infrastructure sectors would be the worst hit whereas IT and banks will be impacted positively.”

According to Ravi Singhal who is the Vice Chairman of GCL Securities Ltd.,

“If the rupee does not strengthen, FPI (Foreign Portfolio Investment) outflows will continue, which is another negative factor for the market. A strong dollar is good for export-oriented companies but bad for import-oriented industries like oil, gas, and chemicals. It is also bad for companies which pay foreign companies royalties for franchises in India.”

Travel to foreign destinations will also be costlier with the rupee losing its value.

However, it has been reported that the RBI is stepping in, in all foreign exchange markets, including spot, forward, and non-deliverable forward markets, and is likely to do so in the near future.

Disclaimer: This article is fact-checked.

Image Sources: Google Images

Sources: Business Standard, The Indian Express, The Hindu

Find the Blogger: @Rishita51265603

This post is tagged under fall of the rupee, depreciation against US dollars, surge in US treasury yields, Russian invasion, stock market crash, rise in price of crude oil, inflation, Foreign Institutional Investors, government bonds, stunted economic growth, rise in cost of studying abroad, surge in international travel cost, intervention of RBI

We do not hold any right, copyright over any of the images used, these have been taken from Google. In case of credits or removal, the owner may kindly mail us.

More Recommendations:

Doesn’t The ₹ (Indian Rupee) Symbol Deserve Way More Recognition On The World Platform?