Retrieved from: Equal Ocean

Author: Yue Liu , Zixuan Kang, Ivan Platonov

In November, Chinese on-demand retail and delivery platform Dada Nexus (DADA:NASDAQ) announced its 3Q 2020 financial results, reporting strong earnings. The stellar business performance spurred investors’ optimism, boosting the company’s market capitalization to USD 11.69 billion at the end of the trading session on November 23.

In this article, EqualOcean analyzes Dada, touching upon the key trends and prospects of China’s local on-demand retail and delivery markets, the ‘lower-tier cities’ narrative, as well as the company’s network and business model’s competitiveness.

3Q 2020 earnings overview

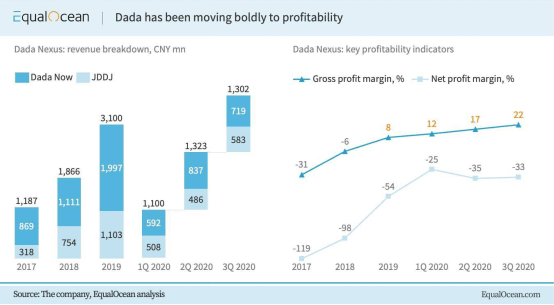

In this quarter, Dada’s net revenue reached CNY 1.30 billion, a year-on-year increase of 85.5%. Meanwhile, the net loss was CNY 434 million, narrower than the CNY 458 million recorded in the second quarter but higher than the first quarter’s CNY 279 million.

Segmentwise, the revenue from ‘local on-demand delivery platform’ Dada Now increased by 81.3% year-on-year to CNY 719 million. In contrast, JD Daojia (JDDJ), which goes by the ‘online on-demand retail platform’ identity, generated CNY 583 million, or 91.0% more than within the same period 2019.

In the 12 months through September 30, 2020, the GMV of JDDJ was CNY 21.3 billion, a year-on-year increase of 102.9%. Over the same period, active consumers on the platform hit 37.3 million, a year-on-year increase of 77.1%, with its market share increasing from 2019’s 21% to 24%, as the company claimed in its financial report. Dada Now, per another projection of the firm, took over 24% of its market segment – on-demand delivery – in China, up significantly from 19% in 2019.

From 2017 to 2019, Dada’s revenue nearly tripled; during the COVID-19 outbreak in China, its growth remained stable. The gross profit margin has been continuously improving from -31% in 2017 to 22% in 3Q 2020, mirroring its strong cost control capabilities. Simultaneously, its losses have been gradually narrowing, from 119% of revenue in 2017 to 25% in 1Q 2020.

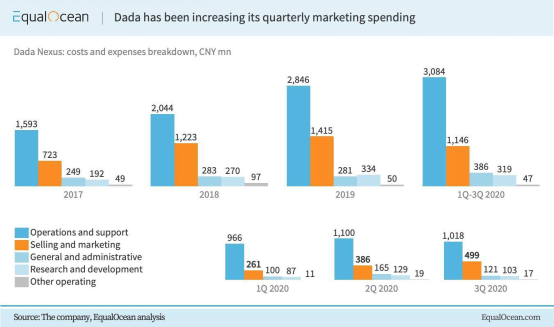

Dada’s selling and marketing expenses have been the only cost-side category growing throughout 1Q – 3Q 2020. Although the company is getting traffic support from JD Group (JD:NASDAQ), its key competitors – Meituan (03690:HK) and Alibaba-backed Ele.me – should not be underestimated the post-pandemic phase of the user acquisition rate.

China’s on-demand delivery market

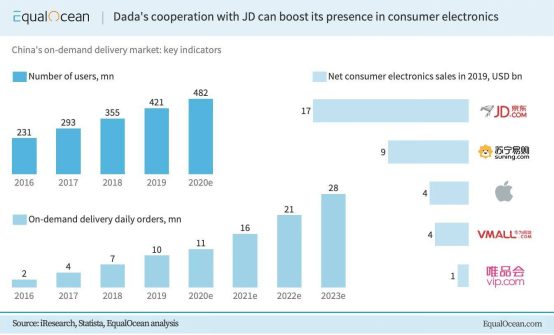

According to iiMedia Research, the number of users in China’s instant on-demand delivery industry will reach (in Chinese) CNY 482 million in 2020. The researcher also projects the number of orders countrywide to grow at a 31% CAGR from 2019 to 2023. Simultaneously, the market penetration growth slows down: the country’s user base added an extra 26.8% in 2017, but only 14.5% in 2020. Thus, the scope expansion and GMV boost are likely to become Dada Nexus’ next priority.

During the earnings call, Dada Nexus’ representatives stated that the company would continue to enter new categories, including consumer electronics. Data aggregator Statista projects the total revenue of this segment in China to reach USD 152 billion in 2020, growing at a 2.8% CAGR in 2020-2025. While the growth seems flat, JD Group’s dominant position in the area is likely to back Dada’s endeavors. (The Chinese e-commerce behemoth owns 47.9% of Dada Nexus, with three board seats, according to the June 5, 2020 version of the delivery platform’s prospectus.)

The ‘lower-tier cities’ strategy

Up to now, Dada Now and JDDJ have covered 2,600 and 1,200 counties, districts and cities nationwide, respectively. And the company is apparently just getting started, planning to continue to make efforts in the so-called lower-tier cities. McKinsey’s ‘China consumer report 2020’ considers ‘Young Free Spenders’ in lower-tier cities as of today’s growth engine. With relatively low work pressure and an underdeveloped sense of saving, they possess tremendous spending power. This segment accounted for only 25% of McKinsey’s survey sample but was responsible for 60% of 2018’s total spending growth over 2017.

The lower-tier cities’ purchasing power has been skyrocketing. The number of households with annual disposable income of CNY 140,000 – CNY 300,000 in tier-3 and tier-4 cities grew more than thirteenfold from 2010 to 2018. By comparison, the tier-1 and tier-2 cities’ figure was up less than sixfold over the same period.

Dada has already started making its way into these promising geographies, with a spectacular speed: in 3Q 2020, the sales volume in lower-tier cities increased by 170% year-on-year.

Bottom line

We hold a rather bullish opinion on the mid-term prospects of Dada Nexus in China. Whilst the recent leap in its stock price might be slightly overshooting, the company is on a clear track and geared up for cutthroat competition in the domestic market.

(Syndicated press content is neither written, edited or endorsed by ED Times)

Read more:

Incidents That Led To India’s Abysmal 142nd Ranking On World Press Freedom Index