The pandemic pushed fast forward on the era of digital payments in India, unlike anything. Suddenly, platforms like Google Pay, Paytm, UPI, PhonePe, and many more have become commonplace in our daily lives. Carrying cash is now almost considered a thing of the past if you use any service these days.

However, all might not be hunky dory, as shopkeepers in Bengaluru are now resisting digital payments and demanding only cash payments.

This twist in events is said to have been brought about due to concerns over tax notices and fear of harassment and other regulatory actions being taken against them.

What Are Bengaluru Shopkeepers Doing?

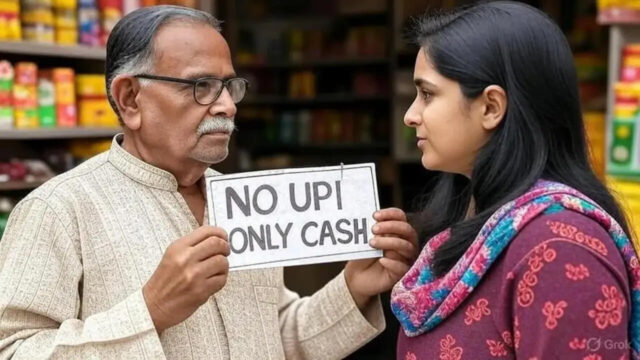

According to recent reports, Bengaluru shopkeepers and small vendors are switching back to cash payments, even going so far as to put up clear notices of “No UPI, only cash.”

The city that is considered the tech capital had once embraced these very digital payments. However, now vendors are claiming that they have received Goods and Services Tax (GST) notices, asking them to register their business, disclose their taxable turnover, and pay the necessary tax on it. Some of these notices have tax demands going into lakhs of rupees.

Under the current GST law, if businesses that supply goods cross an annual turnover of Rs 40 lakh and service providers cross Rs 20 lakh, then they must register and pay the applicable GST amount.

The Karnataka Commercial Tax Department has claimed that the notices were only sent to vendors that crossed these limits.

Vipul Bansal, Commissioner of Commercial Taxes in Karnataka, speaking with Moneycontrol, said, “We have identified 14,000 cases so far. Notices are being issued to those with UPI receipts above Rs 40 lakh. Field officers are verifying how many are registered and compliant.”

Bansal further added that “Right now, only notices have been sent. Let people come forward and explain. Depending on their situation, we will decide. If someone deals only in exempt goods or is under the composition scheme, the tax implication is minimal.”

The reason for the notices was determined based on the Unified Payments Interface (UPI) transaction data from FY 2021-22 to 2024-25.

Read More: ResearchED: How Come The World Never Thought Of UPI Before India Did?

This has resulted in a panic situation for several vendors, who have now chosen to remove the option of digital payments and require only cash payment. Dipu Nair on X/Twitter wrote, “Early morning shocker!! Laundry guy called me to tell me that he no longer accepts UPI payments… He will only accept cash…”

Shankar, a shopkeeper in Horamavu, also said, “I do a business of about Rs 3,000 a day and live on the small profit I make. I can’t accept payment by UPI anymore.”

According to Advocate Vinay K. Sreenivasa, joint secretary of the Federation of Bengaluru Street Vendors Associations, this is because vendors fear being harassed by GST officials and facing possible eviction by civic bodies.

Many believe that the digital trail UPI payment leaves could eventually become a liability for them and their ability to do business, burdening them with lakhs of taxes.

Critics, however, have raised the issue that depending solely on UPI receipts to calculate turnover could be wrong, as the numbers might not be a reality.

HD Arun Kumar, former additional commissioner of commercial taxes in Karnataka, has commented on this, stating that GST authorities cannot just use digital payment information, as they don’t always reflect the true income.

He said, “GST authorities cannot simply quote random figures as turnover,” adding, “Under the GST laws, the burden of proof is on officers. They must establish it before arriving at a tax demand, unlike in money laundering cases.”

A former GST field official also pointed out that digital credit details might not always reflect business income. The official said, “Not all UPI credits indicate business income. Some may be informal loans or transfers from family and friends.”

Image Credits: Google Images

Sources: The Economic Times, Hindustan Times, Business Standard

Find the blogger: @chirali_08

This post is tagged under: UPI, UPI bengaluru, bengaluru, bengaluru vendors, bengaluru shopkeepers, cash payment, cash vs upi, upi payment india, digital payment, digital payment india, gst,

Disclaimer: We do not own the rights or copyright for any of the images used; these were sourced from Google. If you are the owner and require credit or removal, please contact us.

Other Recommendations:

UPI Transactions Responsible For Dying Toffee Business In India