Crude prices are down to almost $47/bbl and while most of Indians are rejoicing and planning to make the most of almost a decade low inflation levels, things are not going that hopeful across the world. Countries like Venenzuela and Russia are barely managing to get by. Russia has been our most faithful ally, down the years. While India imports around 37% of its domestic oil consumption, Russia’s economy is solely dependent on its oil exports. Thus, this blog post will bring you up to date about all the wrongs that Russian economy is suffering from and the reasons behind it.

The crisis was enabled by three types of factors – market factors, political factors, and structural factors.

POLITICAL FACTORS:

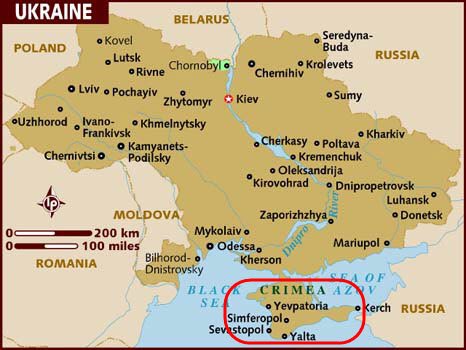

Russia army waged a war in Ukraine and annexed Ukraine’s western territory Crimea in 2014. Almost 3000 civilians were killed in this cross-fire. This move by Russian president was opposed by all the Western powers and was seen as a sort of ego-building exercise by Russian President Vladimir Putin.

Picture Credits-ZeroHedge.com

US along with European Union in a bid to counter-act against Russia imposed economic and trade sanctions against Russia to weaken its economy and degenerate its geo-political sphere of influence. Thus, Russia could no longer import consumables during the harsh winter months from its trade partners. This lead to increase in domestic prices in Russia.

In the third round of sanctions imposed by West, Russian firms were debarred from raising funds from Western markets.

STRUCTURAL FACTORS:

Russia is horribly corrupt with weak institutions and no real property rights. Over the years it has failed to diversify its economy. Current business model of Russian firms showed that they had no faith in future of Russian economy. They used to keep their profits abroad while continuing to operate their businesses within Russia through borrowing. This led to almost a colossal debt of $728bn in January, 2014.

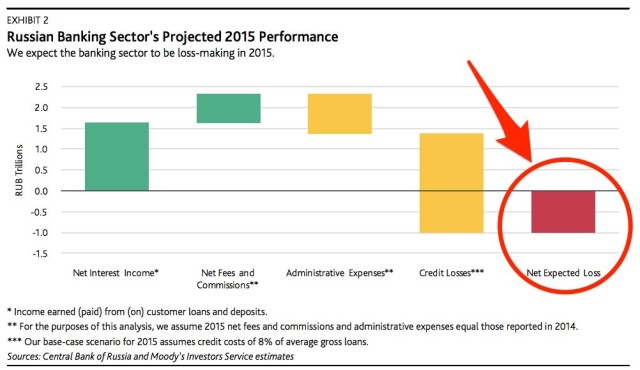

During 2015 Russia’s firms must repay $100 billion-worth of foreign debt. As the rouble slumps, repayment of debt has become increasingly difficult. This brings the dire need for a massive $21bn bailouts of highly leveraged and inefficient state controlled firms which has been announced by Russian Central Bank.

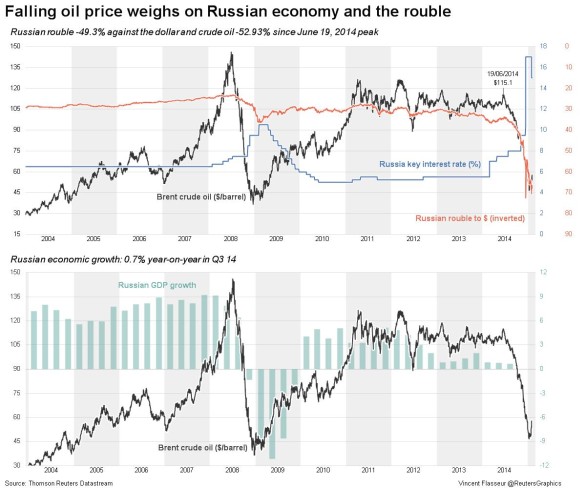

Most noteworthy is the fact that oil and gas exports accounts for 70% of Russia’s revenues. Thus, Russia loses about $2 bn in revenues for every dollar fall in the oil price.

The sharp fall in the value of the rouble, coupled with the near-halving of the oil price, mean more bailouts are likely to be needed.

MARKET FACTORS:

From 2010 until mid-2014, world oil prices had been fairly stable, at around $110 a barrel. But since June prices have more than halved. Brent crude oil has now dipped below $50 a barrel for the first time since May 2009.The reasons for this change are twofold – weak demand in many countries due to insipid economic growth, coupled with surging US production. Added to this is the fact that the both the oil cartel OPEC and Russia itself are determined not to cut production as a way to prop up prices.

The supply of currency in the market from exporters (many of whom also had large debts) declined sharply, while demand from the debtor companies increased. In a bid to protect its currency from downsliding, the Russian Central Bank bought the domestic currency spending $44bn from its forex reserves and raised interest rates from 10.5% to 17%. The latter move sent investors to exit from the stock market and Russian people scurrying over to buy foreign exchange to protect their earnings from eroding away leading to further plummet in Russia’s currency. A record $140bn capital flight was recorded in the country in 2014.

The crisis spread through a sharp increase in the price of imports in roubles and the associated price shock for consumers. Moreover, while loans become less accessible, companies have been obliged to pass on the increased costs of production to consumers.

President Vladimir Putin

Picture Credits: Reuters

Up till now, the Russian President has announced a slew of superficial economic measures to ride over the storm of financial crises triggered on by tumbling of oil prices and his meddling in Ukraine’s internal affairs. He has announced bail-out for banks from a National Wealth Fund meant for pensioners, while ensuring all this while that commoners are secure with their staples to weather the crises i.e bread and vodka.The government has announced that it intends to impose export duties on grain, specifically to lower domestic wheat prices. Putin has also ordered that vodka prices be kept low. More likely, however, Putin knows that high vodka prices invariably correlate to low public-opinion ratings. After all, he must remember his history lessons well, for though his predecessors such as Tsar Nicholas II, the last Romanov, and Soviet President Mikhail Gorbachev may have nothing in common in their fundamental ideologies but they all lost their game of a throne to a pricier bread and a harder to score vodka.

By Shriya Dargan