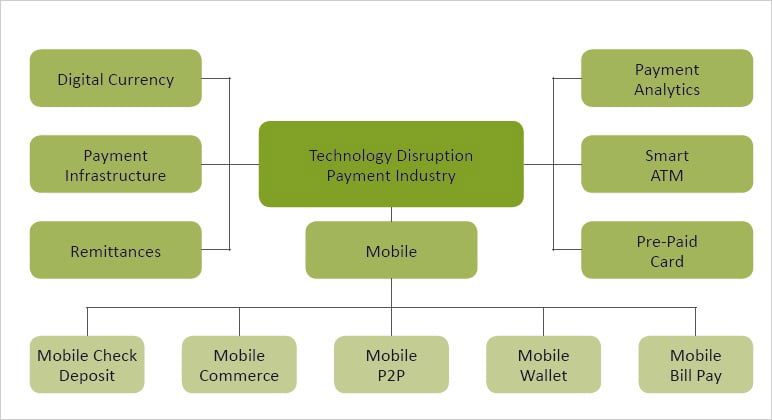

Tired of checking two pockets to make sure your valuables are safe? What if Money Meets Mobile? And we people completely agree with the statement fact that we want our Money safer than our weird selfies. What if you have your Wallet without a Wallet? For the newest way to pay. Yeah, now the convenience of doing a transaction next door is encouraging people to use a non-banking channel than go to a commercial bank.

There are many users who don’t even have a bank account. The Proposed Payment banks are expected to bring banking services to the doorstep of millions of customers in far-flung areas. The company is mainly run by its wide network of Bandhus or business correspondents across the country who are mostly the local people appointed by the company. These agents are equipped with GPRS enabled hand-held biometric devices that reads the Smart Card information with the clients and hence the financial transactions are done in an easy, accessible and cheap way. Their key area of operation is to provide branch-less banking and insurance infrastructure, and assisting government schemes through its technology and agent network.

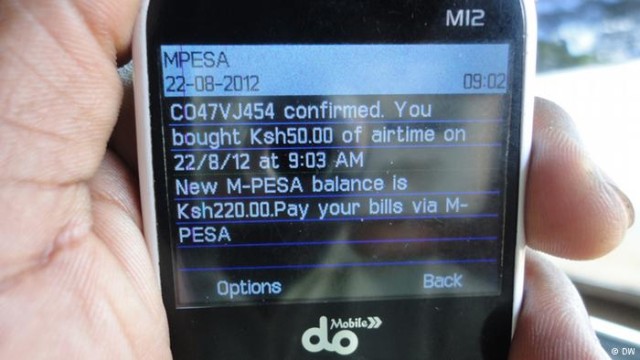

The transaction process in this Branch-less banking is very simple. It requires a mobile number for registration, receiver’s name and bank account along with some other details such as the village and the district area where the money is being transferred. The money reaches the receiver’s bank account instantly via Bank’s payment gateway. There is no physical receipt. The customer gets an instant confirmation on his mobile. In fact, more than the comfort factor, it’s the low cost of transactions that draws customers. An added attraction is the small quantum transaction (as low as Rs 100). Today, a Rs 5000 remittance from anywhere in India will cost Rs 250 at a post office. Rs 100 to Rs 150 at a bank and Rs 75 at an outlet run by the likes of FINO Pay tech.

Effecting withdrawals:

ICICI Bank presents a first of its kind Digital Wallet ‘Pockets’ that can be downloaded and used instantly without going through any hassle of branch visit or submitting documents. You can use it for all transactions like shopping, transferring money, splitting bill with friends and much more. So go ahead, download the newest and coolest digital wallet ‘Pockets’. Anyone, including those who are not customers of ICICI Bank, can easily download the e-wallet from Google Playstore, fund it from any bank account in the country and start transacting immediately, ICICI Bank said in a statement. This wallet uses a virtual VISA card which enables the users to transact on any website or mobile application in India, it said, adding that customers can also request for a physical card to use it at any retail outlet. Users can choose to add a zero-balance savings account to the wallet, which will allow them to earn interest on their idle money, it said. The universal wallet and the savings account are the first two products to be launched as part of the ‘Pockets’ digital bank, it added.

Similarly, India Post, telecom companies through services such as Airtel Money and M-Pesa (Vodafone), prepaid mobile payment instrument providers (Oxygen, Itz Cash, etc.) and business correspondents are also aggressive players in the remittances business. Some of these players could soon offer limited banking services under the services under the Reserve Bank Of India’s (RBI) differentiated licensing. Those who are awarded the Payment Bank’ licence would be able to accept deposits (but not lend), invest in government securities, offer small value payment services (remittances, utility bills, mobile recharge, ticketing) and distribution of investment products such as mutual funds and insurance plans.

SUDDEN NEED FOR PAYMENT BANKS:

“The banking model has worked for only 20 to 30 percent of the population,” says Naveen Surya, Managing Director of Itz Cash. Clearly, the earlier business model for achieving financial inclusion-through multiple financial institutions including co-operative banks, regional rural banks and PSU banks-didn’t yield results. The PSU banks also used the route of self-help groups (SHGs), a financing model for women, and banking correspondents but failed to create any impact.

There does appear to be a massive opportunity for payment banks. But there are challenges also as they are not full-fledged banks offering the whole gamut of banking services. The recent move by the RBI to give a Universal banking to Bandhan Financial Services, a kolkata-based microfinance institution, would result in direct competition to payment banks as Bandhan’s playground is people at the bottom of the pyramid. Similarly, there are private banks in India which are expanding into rural and semi-urban areas with a new business model. HDFC Bank, for instance, has 55 percent of its branches is such areas-it is now setting up small sized branches to control costs. Meanwhile, there could be some tie-ups between universal and payment banks.

Clearly, it is not going to be an easy ride for the new payment banks.

By Pavani Chennamasetti