Staying true to the name of our platform, let us discuss and explore the word economy and it’s consequent state in the country. Now one can indeed take up ET, FE, BS or BL for a week to get a dose of the Indian economy, and yes, there is nothing better than that. But (and it’s a big one) the contributors in these dailies, with all their PHDs and Masters, and batches flashing leadership titles in leading MNCs or local giants, write in a manner which at times becomes difficult to comprehend.

This is to try and present you guys the gist in a manner hoping that while being informative, it will not be uninteresting.

Watsupp with the Economy ? All of us know about it, most of us live here, many of us are familiar with ways around, but only a few know India by the numbers. That’s what this piece is all about. We will try, get acquainted and see the nation in simple teeny tiny figures- Numbers. We’ll try to see how far have we come in the last 10 years.

Let’s take it up step by step.

Current Scenario

Don’t even get me started on the general sentiment. With Mr. Modi in Pradhan Mantri’s chair, there isn’t need for electronic or for the print media to discuss his charming ways. There hasn’t been a greater self-publicist and doer. Had there been a movie on greatest ever administrators ever born, he would have taken more than half of the footage. With Raghuram ‘Rockstar’ Rajan heading the Reserve Bank, we could not land in a sweeter spot, so sweet that the FIIs (Foreign Institutional Investors) couldn’t resist but pour in, this fiscal, more than 1 lac crores rupees in the capital markets. Industry and CXO’s across sectors are brimming with confidence, hoping to witness the India story unfold once again.

The Economic data

Time to take up the economic barometers.

1) GDP (Gross Domestic Product) and Growth Rate –

These two parameters are considered the ultimate benchmark to judge the financial health of a nation. The gross domestic product (GDP) measures the national income and output for a given country’s economy. GDP is the value of all final goods and services produced within the country in a financial year.

Our nation accounts for just 3% of the world economy, with approximately USD 2 trillion of output. But boasting of 14% of the planet’s population, there is still a long way to go.

On the other hand, the annual GDP growth rate measures the %age change in GDP over the years.

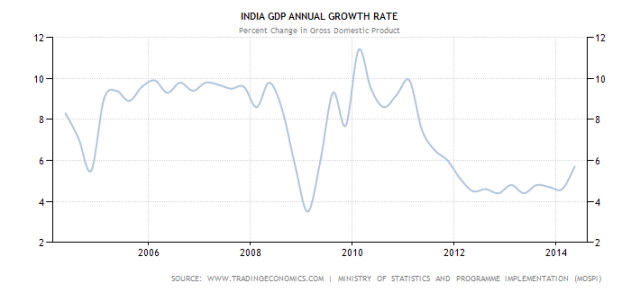

The figure above shows the year-on-year quarterly movement of growth rate from 2004 to 2014

With strong results in Q2,FY15 India is on highway of double digit growth again.

2) CAD (Current Account Deficit) –

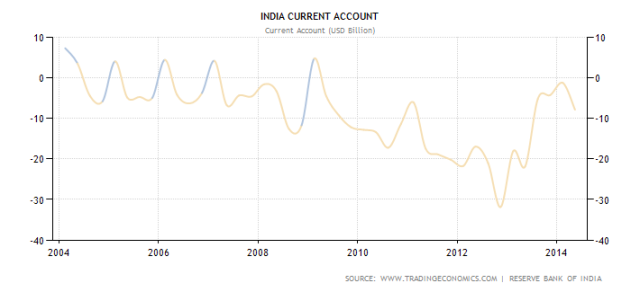

In summary, CAD represents imports being greater than exports. With new initiatives being taken to boost exports, the Current account position is gradually moving into positive territory (see graph below). With CAD expected to come down to 2% of GDP this year from draconian 5% a year ago, it is a testament that our exports are strengthening faster than expected.

3) Capital Markets –

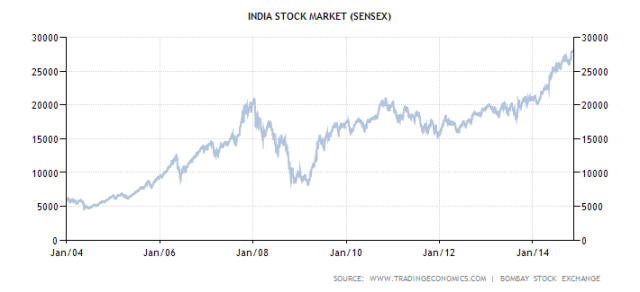

As we have stated earlier, there is no better reflector of an economy than its capital markets.And, one gets fascinated upon looking at the performance of India’s Sensex.

You know what I mean, if you have read our article on the on-going Bull Run (http://edtimes.in/2014/11/samvat-2071-indias-bull-run-continues.html)

Registering robust returns of 26% in the past year is no small feat. One thing is clear, India’s entrepreneurial energy has started to surface, and can well be seen in the secondary markets. Industry and commerce, under a strong government leadership is bound to shoot up.

4) Interest rate, inflation –

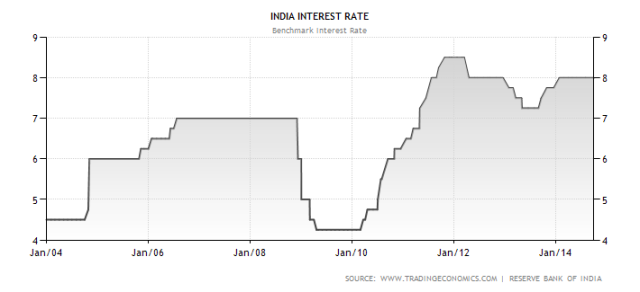

Interest rates are considered to be an important determinant and consequent for supply and demand. The rates directly impact the borrowing costs of the corporates, in turn influencing capital-intensive decisions. While lower rates boost consumer demand, the higher ones are aimed to curtail excess demand (a factor for inflation). The rates are revised quarterly by the Reserve Bank of India. With inflation at historic lows, India Inc. expects the rates to fall from the usual 8% continuing since over 2 years. A rate cut will re-ignite the investment engine once again.

Inflation is a measure of increase in prices over a period. Simply put, it tells how much money entities are willing to let go for the commodities or services. Historically, the wholesale price index (WPI) has been the principle measure of inflation in India. However, in 2013, the governor of The Reserve Bank, Mr. Raghuram Rajan recommended that the consumer price index (CPI) be taken as the new measure. Inflation has been falling drastically from 11% witnessed in Q4FY14 to near 5% this quarter.

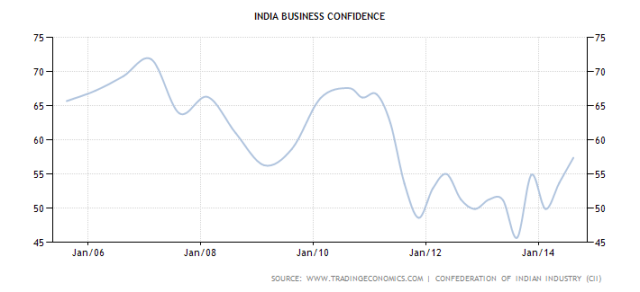

5) Business Confidence Index –

The BCI, reported by the Confederation of Indian Industry (CII), is based on a sample size of around 300 companies covering all industry sectors, taking into account large enterprises as well as SMEs. The indices is based on three questions on the performance of –

- the economy

- respondent’s industry

- And respondent’s company.

Respondents are then asked to rate the current and expected performance on a scale of 0 to 100. A score above 50 indicates positive confidence while a score above 75 would indicate strong positive confidence.

The CCI- BCI has shot up 3 times a row since Q3FY14. The overall mood of the industry is positive, with the index now nearing a 3 year high

How does it all come together ?

With an expectation of higher economic growth this fiscal and the GDP breathing just below the psychological USD 2 trillion mark, and twin deficit – CAD and Fiscal deficit relatively under control, the environment is bubbling with excitement. New records being set in the capital markets and valuations at maddening peaks are an indicative of the potential. With, interest rates and inflation beginning to move around in a comforting manner, the long dormant belief in India’s story has started to subsist with a bang!