Last year, words like IPOs, startups, investing became household names. There was a buzz around IPOs or Initial Public Offering of new-age startups like Zomato, PayTM, and Nykaa. Their demand was extremely high, which created an illusion that it’s the golden age of Indian startups – that they are lucrative investment options.

Why I call it an illusion is because the reality is low laid bare before all of us. The share prices of the aforementioned startups have tanked ever since they got listed in the share market. The investors are looking at huge losses and there is little hope of prices increasing.

Easy Money Days Over?

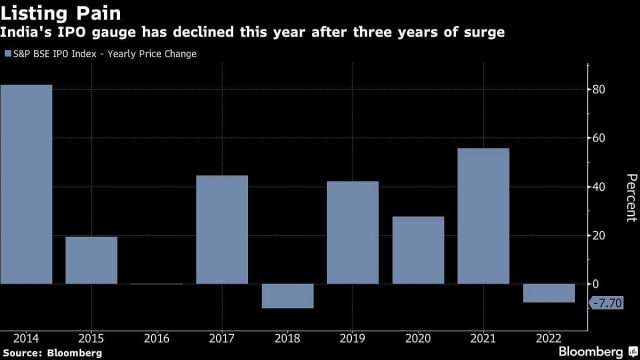

There were 63 IPOs in 2021. Half of them have dropped below their listing price and about 2 dozen of them are below their offer price. This is an alarming situation for the startup industry, but there are lessons in it.

Most of the Indian tech startups are not earning profits. They are burning money to acquire customers, create brand image, etc but the revenue has not been at par with the spending.

“Investors are no longer enamored of the household name startups; they want a path to profitability and returns, not hype and hoopla,” said Anup Jain, a managing partner at Orios Venture Partners.

Mostly young people with little knowledge of finance matters invest in the startups’ IPOs, lured by the prospect of making fast money. This creates an overvalued hype and the bubble is burst when the stock is finally listed in the market.

“Irrational exuberance in the debutants has resulted in unjustifiable valuations for many. These stocks get severely punished during the market crash,” said VK Vijayakumar, Chief Investment Strategist, Geojit Financial Services. He added,

“This need not take away the sheen from primary markets. Only the froth is getting removed. There will always be good demand for reasonably priced IPOs.”

The correction in the equity market gave a reality check to new-age startups. Vijayakumar said, “IPOs with lofty valuations will face lukewarm response from investors; valuations should be realistic to fetch decent listing gains”

Read More: Can IPOs Make You Rich?

Lessons For Startups Set To Release IPOs

This year, the two most-talked-about IPOs were going to be that of Oyo Hotels and Delivery. However, both the companies have pushed further their dates of launching IPOs, carefully assessing the situation.

Delhivery had planned to complete listing by March but now the date has been shifted when the stock market regulator scowled on the sale of the substantial number of shares by investors.

Oyo also received flak due to its ownership structure and losses after it filed its preliminary IPO documents.

The current buzz is made by the LIC IPO. How the market reacts to its listing will set the tone for other tech startups too this year. If LIC’s IPO takes off, there may be optimism to invest in other IPOs also. If it doesn’t, then it remains interesting to see how new-age startups would adapt.

Disclaimer: This article is fact-checked

Sources: LiveMint, The Print, Economic Times +more

Find The Blogger: @TinaGarg18

Image Sources: Google Images

This post is tagged under: startups, startup ipos, nykaa, paytm, zomato, tech companies, business, indian economy, sensex, nifty, initial public offering, investor, losses, high returns high risk, LIC, oyo hotels, pharmeasy, delhivery, share market, offer price, sebi, listing price, red herring prospectus

We do not hold any right/copyright over any of the images used. These have been taken from Google. In case of credits or removal, the owner may kindly mail us.

Other Recommendations:

Are IPOs A Trap And What All To Take Care Of Before Investing In Them?