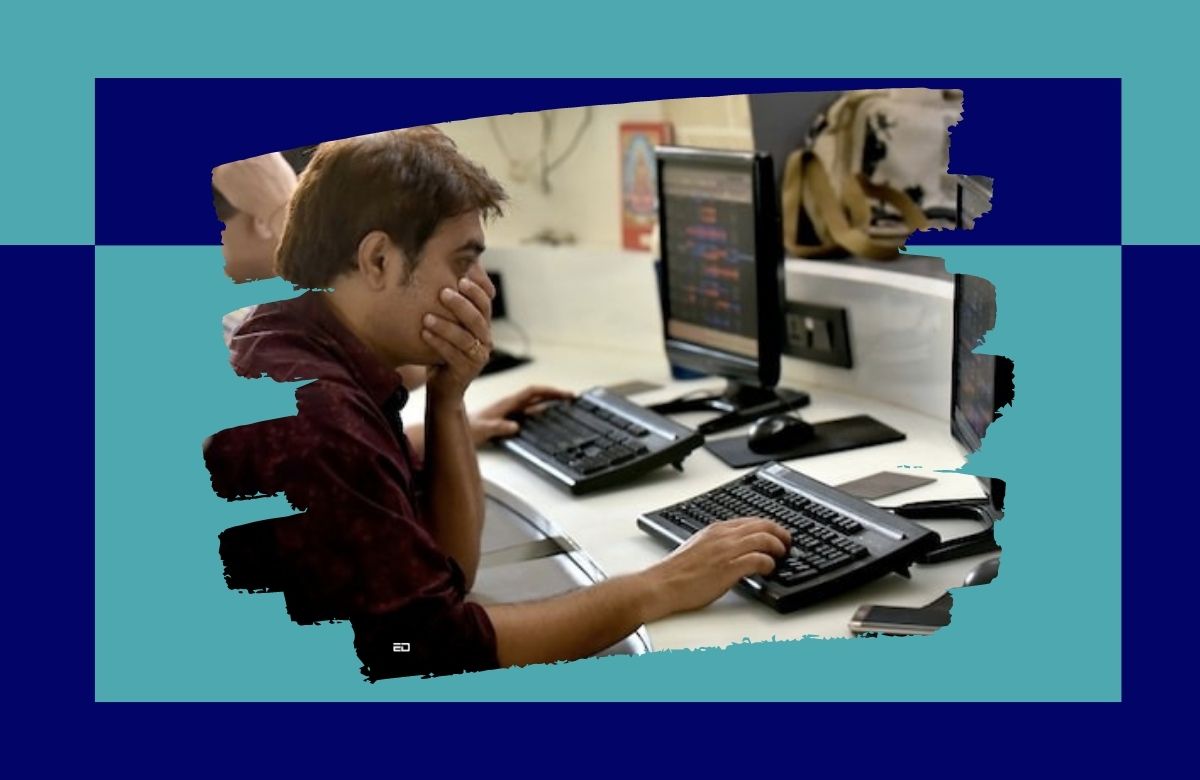

An unknown broking house in India could have suffered a loss of rupees 200-250 crore due to a broker’s “fat finger” trading mistake. This is by far the biggest trading mistake that India has made in a long while.

A fat ‘finger’ trade is caused when somebody punches in a wrong key or ‘mis-clicks’ on something. It is an erroneous action that works for both parties of the trade – fairly badly for the initiating party though, while people on the other end enjoy the gains.

Read more: Are Latest Economic Trends Warning Us Of A Possible Financial Crisis Like 2008?

On the fateful afternoon of Thursday, 3rd of June, the fat finger trade hit NSE’s derivative segment hard.

Between 2:37 pm and 2:39 pm, a trader from the said broking house sold about twenty-five thousand units of NIFTY call options at really low prices, at around rupee 0.15, the strike prices of which were Rs. 14,500.

The said NIFTY contracts had about 50 numbers each. The market price of each contract was Rs. 2,100 at that time.

One wrong click, and poof! There goes away Rupees 250 crore. This funny albeit unfortunate event has yet again caused considerable commotion at the NSE.

Earlier a similar trading mistake had led to a major loss of Rs. 60 crore. That was a decade ago. Since then, state-of-the-art alert systems and various updates were installed in order to avoid such erroneous transactions from occurring. However, according to sources, no alert systems had kicked in to save the day on Thursday.

Image Credits: Google Images

Sources: The Times Of India, Indiatimes, Business Today

Find the blogger: @SreemayeeN

This post is tagged under: NSE, economy, india, Business, Stock Exchange, Broker, loss

Disclaimer: We do not hold any right, copyright over any of the images used, these have been taken from Google. In case of credits or removal, the owner may kindly mail us.