We all love mobiles. Imagine that you have 10 Iphones which aren’t of any use to you. What do you do? You go to a mobile store to showcase all of them. The store owner isn’t buying as he already has over stocking. To showcase all of them in his store, he asks you to give 50% of the proceeds to him. (And you are Gordon Gekko).

What do you do? You don’t go to the owner and you start selling the I-phone yourself or give it to a mobile dealer who further sells it and give you the majority cut. Great!

Replace Iphone by a stock in the given situation and mobile store as a stock exchange and you will get the answer to why not all the companies sell securities through a stock exchange.

WHAT DOES O.T.C. MEAN?

Over The Counter means a way of transaction where a stock, bond or other financial instruments like derivatives are sold through a network of dealers and not through a formal exchange (like B.S.E.,N.S.E.). Unlike exchanges, OTC markets have never been a “standardised place of exchange”. They are less formal, although often well-organized, networks of trading relationships around one or more dealers.

HOW DOES IT WORK?

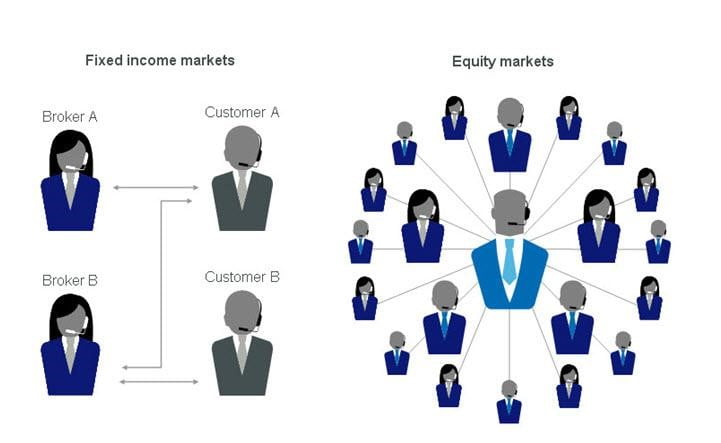

Dealers act as market makers by quoting prices at which they will sell (ask or offer) or buy (bid) to other dealers and to their clients or customers.

Let’s say that your business entity A wants to issue debt. For this it issues bonds. You can’t call your relatives and tell them to buy the bonds. What you do is that you call an investment bank B and tell it that the rate of interest you want is atmost 10% and the amount of debt to be raised. The investment bank then “makes the market” and asks for quotes through its dealer networks. The debt market is OTC market.

WHY IS O.T.C. NEEDED?

There is a reason why the bond market which is almost 4 times the size of equity market (in India) is not traded through formal exchanges. This is because debt can vary in so many ways that it will be really difficult to list every class of bond. Bonds can vary in interest rates, maturity, price, borrower, credit rating which isn’t the case in equity.

Don’t worry. Not every stock that is issued in the country is traded through B.S.E. & N.S.E. The reason for which a stock is traded over-the-counter is usually because the company is small, making it unable to meet exchange listing requirements. For a company to issue equity, it needs to have at least 1 cr of total assets which isn’t that easy. Also known as “unlisted stock”, these securities are traded by broker-dealers as well.

If you liked reading this, you will also like:

Hedge Funds: How They Work & Why They Are Scary