By Hitee Singh

Royal Dutch Shell, the seventh largest company in the world as of 2016, in terms of revenue acquired British Gas Group (not to be confused with British Gas) for USD 70.1 billion on 15th February 2016. This acquisition is being touted as the fourteenth largest acquisition in oil and gas industry and the largest in this year.

Talks of a big oil company like ExxonMobil or Shell acquiring a smaller rival were doing rounds since summer 2014 when the oil prices were as low as USD 30 per barrel. Since 31st March Shell and BG had started formulating the conditions of the deal. According to it, BG shareholders will be entitled to receive, for each share BG share- 0.4454 Shell ‘B shares’ and 3.83 GPB (USD 5.60). At the end of the transaction, BG shareholders will own 19% of Shell. Shell expects to commence a share buyback programme in 2017 of at least $25 billion for the period 2017 to 2020.

The companies then consulted their shareholders and more than 80% of the shareholders of both the beneficiaries approved of this deal. The deal also needed approval from a raft of regulators including the European Commission, Brazil’s CADE, China’s MOFCOM, Australia’s regulators and a special written permission from the UK’s Secretary of State to say that BG’s exploration and production licence won’t be withdrawn. This made Shell the largest private oil producer in the world, second only to ExxonMobil.

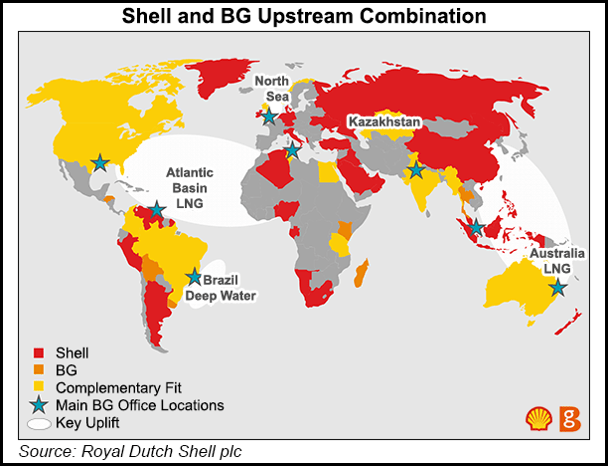

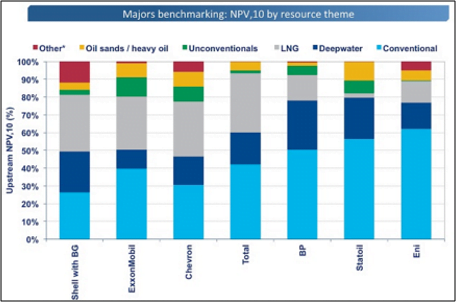

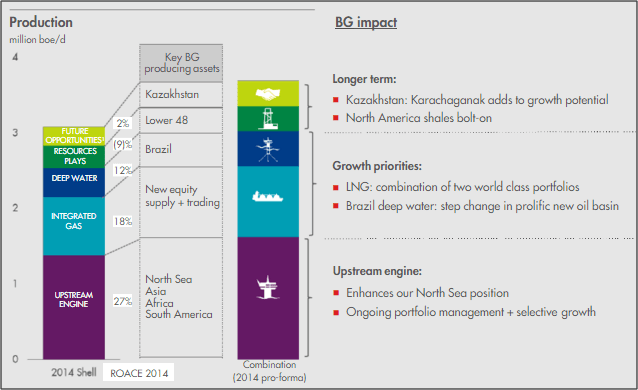

Shell’s proved oil and gas reserves would increase by about 25% and its production by 20%. It would become the biggest liquefied natural gas firm in the world. It will get access to significant resources off the coast of Brazil. BG adds attractive deep water and integrated gas positions and will act as a catalyst for accelerating the reshaping of Shell’s business. Shell will liquidate $30 billion worth of assets over the next three years and let go of its unconventional assets as it focuses on LNG and oil.

This will help Shell replenish its declining oil assets. Plummeting oil prices have put a premium on proven assets and acquiring BG is cheaper than expanding its own explorations. Though it bought it at a price 50% higher, analysts predict the rise of oil price by 2018 which will make up for any loss that Shell incurs. The market capitalization of the combined firm will be almost USD 177 billion.

Reducing oil prices were decreasing the revenue of BG. It couldn’t expand with the resources it had and selling seemed the best option. Together the 2 firms will control a significant amount of LNG supply of the world. However, the LNG demand growth is waning. Rising construction and maintenance costs have made LNG imports less appealing to many customers. This deal also jeopardizes the deal for exporting natural gas to the partners in the Leviathan reservoir to BG. The company’s image could also be affected by Petrobas corruption scandal.

LNG and oil market is volatile and niche and the fluctuating oil prices make it difficult to predict if this move will be beneficial to Shell in the long run. Even as Shell claims LNG as the driving force to seal this deal, everyone knows that oil will be profitable if not today than tomorrow. By emphasising on LNG it tactically diverted everyone’s attention from the fact that the supermajors are now ill-placed to cope with a low oil price.

Winternship Partners:

DHFL Pramerica is one of the fastest growing life insurance companies in India taking care of customers’ various financial protection needs such as savings, wealth creation, etc. Call to build your bank balance! https://www.dhflpramerica.com/

Tellofy is an online word of mouth app, where you can post real reviews & feedback about anything! They make sure it reaches the brand, so they can work on it. Get connected now and save yourself from fake reviews. Get the app to get Tellofy-ing! http://www.tellofy.com/

SWAYAM by FICCI’s FLO is to support women and students aspiring to be entrepreneurs, with mentorship, consultancy, investment, growth & network. Register to become one! http://swayam.ficciflo.com/