By Bhoomi Jain

BUT I’M BROKE.

Well, did I just write what has been on your mind for quite some time now? Whoa, I didn’t know I could read minds. Duh! Who am I kidding? Isn’t everyone broke? I really hope that everyone is otherwise I’m the only sad sally.

Being broke at the end of the month is not only about teens these days, but about everyone. On the 1st of every month, you feel like a rich king of the world with all the money that you could throw around without thinking twice.

New dress, check. New Shoes, check. New furniture, check. Party Weekend, check.

New Shoes, check. New furniture, check. Party Weekend, check.

New furniture, check. Party Weekend, check.

Party Weekend, check.

You spend it like water as if you aren’t ever going to run out it. Then half way through the month you realize: Oh no! Again? Did I REALLY screw up again?

When you check your balance you realize that now is the time when all the math you learnt in school is going to be put to use. Otherwise all the thoughts of dying ’cause of starvation or maybe, having to live the rest of your life in a box, come to your mind. Then comes the usual beg, borrow & steal. That’s easier for teens though with their parents to back them up, a major reason why I don’t want to grow up!

Then as usual, at the end of the month, you promise yourself to save and take control of your expenses from the next month BUT!

NEXT MONTH:

Seriously? Do I even need to say what happens?

Here are some cures for your lean purse that will help you avoid this dilemma next month! Here are the tricks that can help the little fortune sustain in your pocket:

1. Budget it!

Plan a weekly budget and stick to it. This will ensure that you never fall short of the green notes. Even the Indian government follows a budget and tries to stick to it so try hard and maintain an expenditure diary.

2. Learn to say ‘no’: Spend less, save more. That’s the most basic thing you need to know. Do not waste your money on unnecessary things. Resist that temptation and you will be the master of your fortune. At the end of the year when you see your savings, believe me, you will be so happy that you would want to cry.

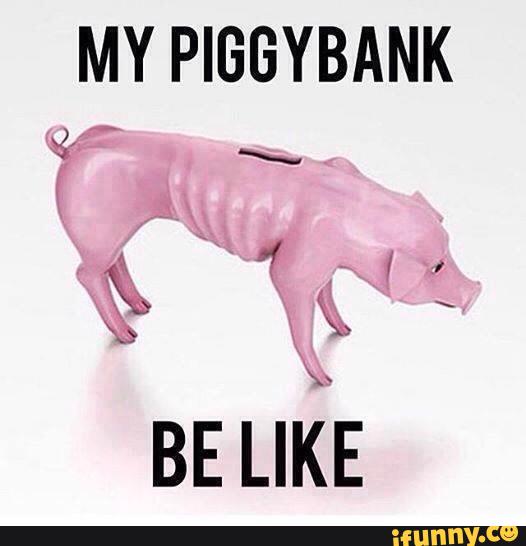

3. Create a reserve: From the money you have to spend, figure out a small percentage that you want to put in your savings. Be it your piggy bank at home or a bank account. Make it a habit of saving a small amount of your savings to meet the urgent needs. Now that’s how we squirrel it. You will sleep much soundly knowing that yes you have the secret 500 rupees to spend on a sudden emergency birthday party.

4. Make thy gold multiply: Be smart at where you invest. Invest in a good business. Grab the right opportunity and let your money multiply. So don’t give money to friends who you know won’t ever return it, that’s a very bad investment :P

5. Remember that every penny counts: As long as it doesn’t belong to someone else, pick up every little coin you see out there. Remember that no matter how little you spend, it’ll make a difference in the long run. It’s similar to 100,000 individuals saying that their vote doesn’t matter, but together they can make a difference. Build a jar with all the change you see, this change will bring a lot of change when you broke and want an ice cream.

VOILA! Hope this helps you to be your own finance master.

Well, we all know no one’s going to follow it, but it never hurts to try, does it?