On July 18, 2024, Indian crypto investors faced a rude awakening. WazirX, one of India’s largest cryptocurrency exchanges, suffered a security breach, leading to the loss of $230 million. If you think that sounds like a scene from a high-stakes thriller, you’re not too far off. The hack wasn’t just about numbers; it left investors reeling, many of whom had their life savings wiped out.

What Is Cryptocurrency?

In the simplest terms, cryptocurrency is a form of digital or virtual currency that relies on cryptography for security. Unlike regular money, cryptocurrencies like Bitcoin, Ethereum, and Dogecoin are not controlled by any government or central authority, such as the Reserve Bank of India (RBI).

Instead, cryptocurrencies use a technology called blockchain, which is essentially a decentralized, distributed ledger where transactions are recorded. This means every transaction is visible to everyone on the network but cannot be altered, making it nearly impossible to cheat the system.

The first and most famous cryptocurrency, Bitcoin, was created in 2009 by an anonymous entity known as Satoshi Nakamoto. Today, Bitcoin remains the most valuable cryptocurrency, with a market cap of over $500 billion as of 2024.

Cryptocurrency In India

India has become one of the fastest-growing markets for cryptocurrency. According to a report by Chainalysis, India ranks fourth in the world for cryptocurrency adoption, with over 15 million active users. The Reserve Bank of India estimates that over ₹6 lakh crore ($72 billion) worth of cryptocurrency transactions took place in India during 2023 alone.

But here’s the catch: cryptocurrency is largely unregulated in India. While the government taxes gains from cryptocurrency investments at a 30% flat rate, there is no comprehensive legal framework to govern how cryptocurrency exchanges operate. This leaves investors vulnerable to hacks, scams, and fraudulent activities.

The lack of regulations also makes it difficult for victims of crypto scams to recover their funds or hold anyone accountable. The WazirX hack is a prime example of how this unregulated environment can turn into a disaster for investors.

The Hack That Shook India’s Crypto Space

WazirX’s wallet, managed in part by a digital asset custody service called Liminal, was compromised. The hackers exploited a vulnerability in the multi-signature wallet system, which required multiple key holders to approve any transaction. Five of these keys were with WazirX, and one was held by Liminal.

How did the hackers manage to breach such a seemingly secure system? It appears they manipulated data discrepancies between what was displayed on Liminal’s interface and the actual contents of the transaction. The cybercriminals gained access to four of the six keys required to move funds, essentially unlocking the digital vault.

To make matters worse, the attackers employed sophisticated techniques like “chain hopping” (transferring funds across multiple blockchain networks) and used services like ‘Tornado Cash’ to obfuscate the stolen assets. Tracing the money became as elusive as finding a needle in a haystack, with experts suspecting the notorious North Korean Lazarus Group behind the attack.

Is It Just A Hack, Or A Larger Scam?

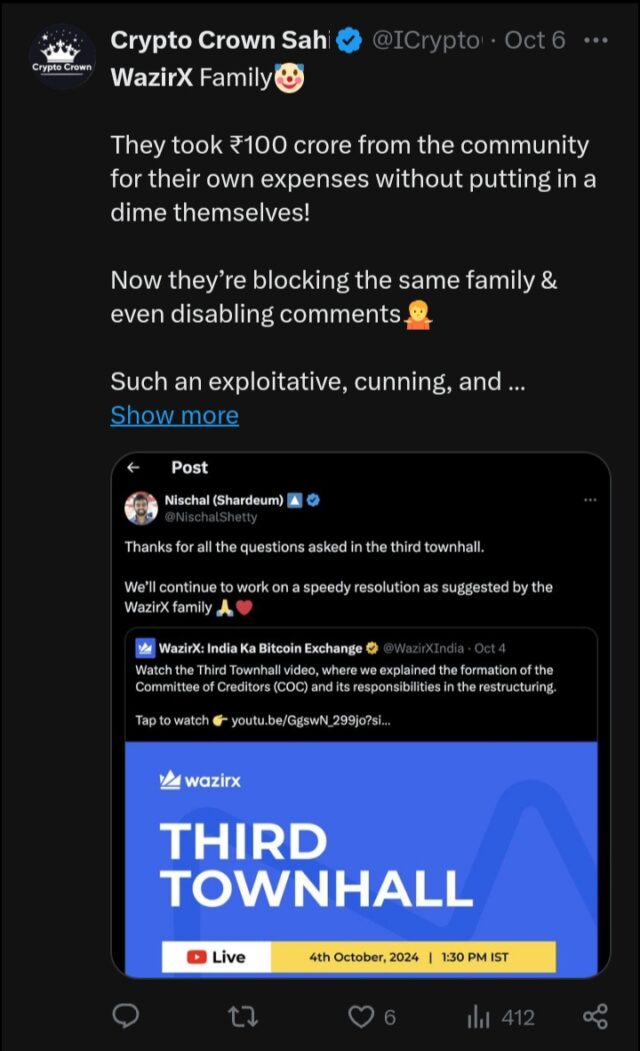

Many WazirX users feel that the hack is part of a larger scam. The company’s response has raised more questions than answers. For instance, users were locked out of their accounts and could not withdraw their remaining assets post-hack.

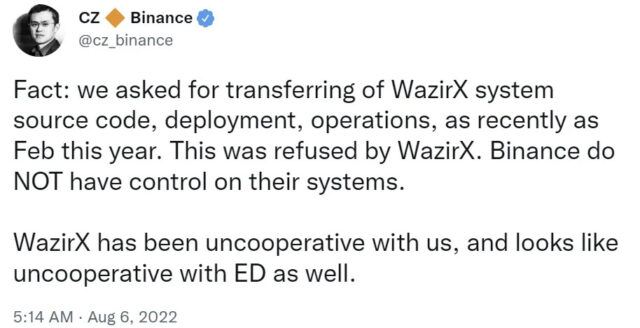

WazirX’s CEO, Nischal Shetty, claimed the company was sold to Binance, an international exchange, and that they had no funds to compensate users. Binance, however, promptly denied any such ownership. This left WazirX users confused and angry, wondering who is accountable for their lost investments.

Harsh Gupta, a 19-year-old investor who lost ₹78,000 in the hack, described the experience in a conversation with The Hindu, as a “living nightmare” for many of his peers. He explained, “Many people I know can’t live a normal life now. They can’t eat, they can’t sleep.” The emotional and financial distress caused by this hack has been devastating, particularly for those who invested heavily in the platform.

Read More: Watch: Five Reasons Why You Should Use Cryptocurrency

A Regulatory Vacuum

While cryptocurrency gains are taxed in India, there’s no comprehensive regulatory framework to protect investors from these kinds of incidents. Without a clear set of rules governing digital assets, investors are left to fend for themselves when things go south.

In a country where cryptocurrency is growing in popularity, this regulatory gap is a glaring oversight. The lack of governmental action has led many to believe that these frauds are being enabled by the absence of a robust legal structure.

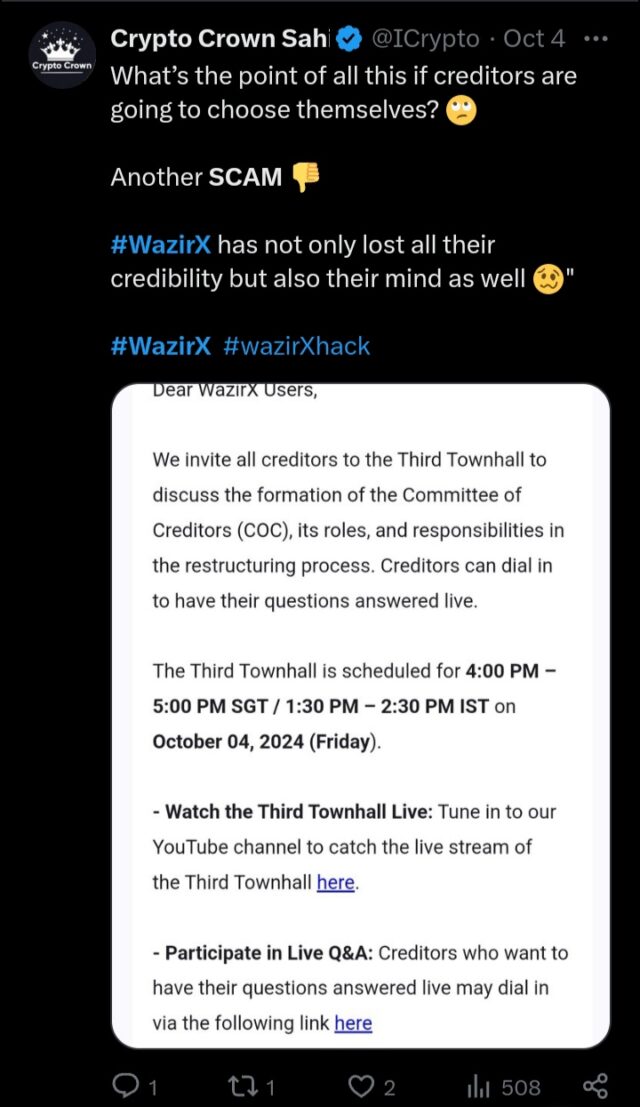

This isn’t the first time Indian crypto users have been left in the lurch. The restructuring of Vauld, another cryptocurrency exchange, serves as a grim reminder. Vauld users lost large sums of money when the platform suspended withdrawals in 2022, and the company’s restructuring process was widely criticized as unfair and deceitful. The parallels between Vauld and WazirX are striking, making investors wonder if they will ever see their money again.

The Aftermath And Victims’ Fight For Justice

Amid growing frustration, a group of WazirX users has banded together to demand justice. An X account (formerly Twitter) called ‘Justice for WazirX Users’ claims to represent over 4,500 victims, 60 of whom have already filed cyber complaints. The group’s administrator stated, “The way the hack occurred raises multiple questions about whether it was genuinely a hack or an insider job. It’s troubling that our fate is being decided by a foreign jurisdiction.”

Many users, like 33-year-old IT professional Mayank Bhatodra, trusted WazirX because it followed KYC (Know-Your-Customer) norms and allowed transactions in Indian rupees. But after the hack, Bhatodra found his holdings locked, with no clear timeline for recovery.

“In a market as volatile as cryptocurrency, locking users’ funds for an extended period is extremely risky,” he said. Bhatodra’s frustration is palpable. Like thousands of other WazirX users, he feels abandoned by the platform and overlooked by the government.

What Needs To Change?

This hack isn’t just a wake-up call for cryptocurrency users; it’s a loud alarm for the Indian government. Without a regulatory body that oversees crypto exchanges, we are likely to see more such incidents in the future. As digital currencies become more mainstream, the need for investor protection cannot be ignored.

Users like Shiva Kumar, a homestay owner in Karnataka who lost over ₹15 lakhs in the hack, have been vocal about the need for a dedicated regulatory body. “WazirX’s failure to maintain transparency has caused immense mental distress, financial harm, and uncertainty about the safety of our investments,” Kumar said.

India has the talent, the technology, and the user base to become a leader in the cryptocurrency space. But without proper regulation, it risks becoming a haven for scams and hacks, leaving honest investors to bear the brunt of these disasters.

The WazirX hack exposed the fragility of India’s cryptocurrency landscape. Beyond the technical breach lies a deeper issue—a lack of government oversight and regulation that leaves investors vulnerable. As WazirX users grapple with their losses, their questions remain unanswered: Why was their money lost? Who is responsible? And most importantly, will the government finally step up to protect its citizens?

India’s cryptocurrency boom can either flourish under strong regulation or continue to see its investors fall prey to scams. The choice lies in the hands of lawmakers.

Image Credits: Google Images

Sources: The Hindu, Times of India, NDTV

Find the blogger: Katyayani Joshi

This post is tagged under: Crypto Scam, WazirX Hack, Cryptocurrency Fraud, Crypto India, Blockchain Security, Crypto Awareness, Digital Currency Risks, Indian Crypto Market, Crypto Regulation, Crypto Hacks, Stay Safe Online, Crypto Investing, Cryptocurrency, Phishing Scams, Cyber Security

Disclaimer: We do not hold any right, or copyright over any of the images used, these have been taken from Google. In case of credits or removal, the owner may kindly mail us.

Other Recommendations:

People Share Personal Experiences Of How They Feel CRED Scammed Them