Ever wondered why a rich man is rich? How does cash makes its way to his pocket? Yes, the ‘cash’ which makes the pocket heavier and gives the brain a high.

Well, this is not an attempt to explain the complex cash flow statement, rather it is to simply comprehend its movement. How cash flows in and out of rich man’s pocket is what we will figure out.

Considering that many here will be from fields besides commerce, we first start by understanding 4 fundamental terms of finance. Later on, these terms will help us in appreciating the patterns better.

Disclaimer- The definitions below are a bit vague, request the commerce population on the page to keep their calm.

Okay, so how do we get money to spend for pampering ourselves or to buy things benefiting us perpetually? Moreover, how do we get the ‘paisa’ to incur daily expenses and to build assets? As we all know money is either earned or borrowed. The former means income and the latter are liabilities. Simply put, income is any source of money coming in regularly, a liability on the other hand is an obligation requiring an outflow of cash in future.

But, how do we utilise this money? We either spend it on daily expenses or use it to acquire things enhancing our overall capacity and power. Broadly saying, all short term pleasing and tempting activities are expenses (pizzas and gadgets for my comrades). Just remember- whenever you find yourself using the phrase ‘khaya, piya, chutti’ for any doodah, its an expense. The other end of the spectrum goes into buying items which assist us over time, these are assets. We recognise assets as holdings we are proud of (dear, it doesn’t count the Iphone on your desk) –consider an asset as possessions and advantages working to make money on money.

Let us summarise the above discussion in the following lines-

Build assets, earn money,

Adopt liabilities, part with future unrealised cash.

We are now ready to read and interpret these ordinary yet powerful diagrams illustrating the flow of cash in and out of the pocket of the poor, the middle class and the super-rich.

Below is the cash flow pattern of a poor person:

Ordinarily, when this category receive their earnings, they pay others first, and use whatever little left for themselves. By paying others upfront, they tend to do away with a huge chunk of the amount they receive, and end up leaving too less for themselves.

Ordinarily, when this category receive their earnings, they pay others first, and use whatever little left for themselves. By paying others upfront, they tend to do away with a huge chunk of the amount they receive, and end up leaving too less for themselves.

This is what happens with the poor – not having enough they are just able to survive.

Since they don’t have the assets to make money work for more money, this makes them work for it. There is neither a big kitty of assets nor are they capable of taking on liabilities. Expenses are all that are paid off with whatever they earn.

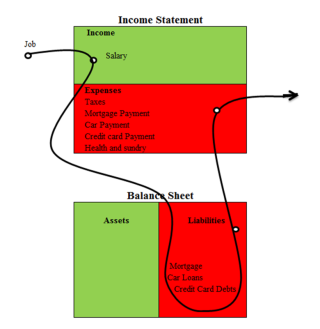

Now, for the cash flow pattern of a person representing the middle class:

This category of individuals too are making both ends meet but in a way better than the poor.

This category of individuals too are making both ends meet but in a way better than the poor.

They are the docile cows getting ready to be milked. Although their salary allows them to have some luxury, but this luxury burns holes in the pocket if not used with sense. The trap of credit cards and debt make the borrowed assets a burden. The surplus if not invested in proper avenues messes up the financial goals pretty quick.

The flow usually involves using the earnings to pay for expenses and to service the liabilities. As the habit of investing is absent, the assets don’t grow. Indulging in small luxuries and sustaining those dries up the remaining cash.

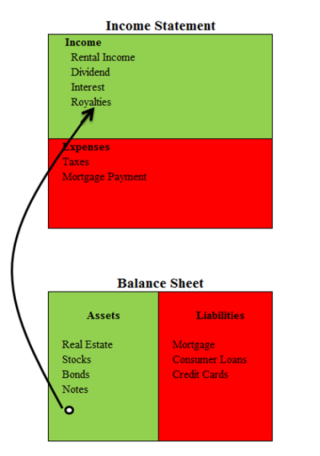

Now, for the pattern of a rich person:

The above pattern shows the flow of liquidity in and out of a rich man’s pocket. This category builds assets and keep patient to let them do the wonders.

The above pattern shows the flow of liquidity in and out of a rich man’s pocket. This category builds assets and keep patient to let them do the wonders.

This ‘virtuous’ cycle multiplies the gains and allows the law of compounding to come into play and do wonders with the wealth. Apart from covering the routine expenses, the surplus from the assets is enough to be reinvested and strengthen the overall financial standing.

Agreed that the diagrams are oversimplified, but the intention is to depict the pattern of flow of cash in a rich man’s pocket in an elementary manner.

Everyone have basic needs and desire luxury. The basic needs can be met by income but one truly gets entitled to luxury only with the money from the assets. The mistake of basking in luxury on borrowed funds proves costly. The rich understands this and mitigates the adversity faced by the poor and the middle class. The conclusion is simple

- The poor have expenses and no assets.

- The middle class buy liabilities they think are assets.

- The rich buy assets and make them work. Not themselves.

The chief point however is –

The writer shares thoughts expressed by Mr. Robert Kiyosaki in his book titled “Rich Dad Poor Dad”.

For the book refer : http://www.flipkart.com/rich-dad-poor-english/p/itme5yzfffbrfgjh?q=Rich+Dad+Poor+Dad+%28English%29&as=on&as-show=on&otracker=start&as-pos=p_1_rich+dad&pid=9781612680019