November 02: Over the last many years, term sheets have become more and more complex. Multiple investors investing across multiple funding rounds makes Liquidation Waterfall extremely challenging especially with other factors coming into play – Liquidation Preference, Participating vs Non-participating, Participation Cap, Seniority, and so on. In this article, my attempt is to explain this complex topic in a simplified manner along with examples.

What is a Liquidation waterfall?

Simply put, liquidation waterfall is the method in which a company’s investors and shareholders will be paid out upon liquidation. In other words, the liquidation waterfall defines who gets what at the exit.

What is Liquidation Preference?

A company can have two types of stocks – preference stocks, generally owned by investors, and common stocks generally owned by founders and employees. Liquidation preference is the mechanism by which preference stockholders receive priority over the common stockholders upon a liquidation event. It is usually expressed as a multiple of the amount invested via preference shares. A 2x multiple would mean on liquidation the preferred stockholders of the respective funding round will receive two times the invested amount before anyone else below them in the waterfall.

As a thumb rule LIFO (Last in First Out) method is used to define the “Seniority” in the liquidation waterfall. This means after settling the debts owing to the creditors, the investors of the last funding round will be paid first, and the founders/common stockholders will be paid last. Simply put, later investors get higher preference however if seniority is pari passu then investors across all funding rounds have the same seniority status.

Types of Preferences

There are three types of preferences:

Non-participating – such stockholders will be entitled to a multiple of their initial investment plus any arrears of dividends owed on those shares as proceeds or choose to convert to common stock if the payout from common stock is more than the liquidation preference.

Participating – such stockholders will be entitled to a multiple of their initial investment plus any arrears of dividends owed on those shares plus participate along with the other shareholders in the proceeds left after all the preferred stockholders have been paid. Such investors are effectively paid twice, once with the preferred stockholders (liquidation preference) and then with the common stockholders (pro rata basis). Therefore, these types of shares are also known as double dip.

Capped Participating – such stockholders will be entitled to a multiple of their initial investment plus any arrears of dividends owed on those shares plus participate along with the other shareholders in the proceeds left after all the preferred stockholders have been paid with a cap on the return. It can be seen as a compromise between the above two types.

How does the liquidation preference impact the liquidation waterfall?

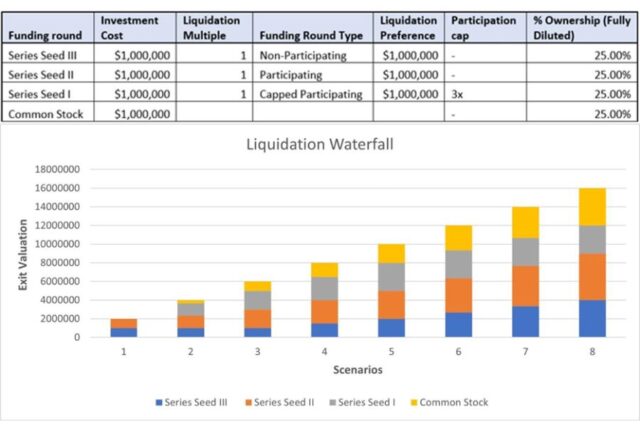

Let’s take a simple example to understand the effect on returns based on the liquidation preference. For ease of understanding we have assumed there are no debts or outstanding dividends. Let us now see the change in returns at different valuations:

It is clear from the above example (Scenarios 1 to 2) that if the valuation is less than or equal to the total investment cost of all funding rounds, the funding round plays a key role as the LIFO method is followed and the investors of the latest round get the highest preference. However, as the company valuation increases (Scenarios 3 to 8) the liquidation preference plays a more significant role in the waterfall.

Initially, MS Excel may help you manage your investments but eventually, the number of funding rounds and investments increases, the complexity increases, and the need for software arises. Luckily there are a few software solutions available that help you easily configure your waterfall and calculate the returns at different quarterly valuations at a click of a button and generate reports.

Evaluating and implementing software may sound intimidating but surely is an interesting journey. Modular software solutions allow going live gradually and do not necessarily take a big-bang approach. However, the question the funds’ team finds difficult to answer is – “When” is the right time to go for a suitable solution?

Alexandre Graham Bell said, “The only difference between success and failure is the ability to take action.” One day or day one is a decision you need to make!

(The author of the article is Ms. Vasundhara Gupta (Associated Director – Sales & Key Accounts, PE Front Office)