CEOs from CII Northern Region anticipate Government support towards payment of wages to industries impacted by the lockdown: CII Northern Region Snap Poll Reveals.

A recent snap poll conducted by the Confederation of Indian Industry to assess the impact of the lockdown due to COVID 19 amongst the CEOs from CII Northern Region suggests that COVID-19 and resultant lockdown is likely to have a deep impact on Indian businesses.

However, on the positive side, three-fourth of respondents were of the view that India is better placed as compared to other countries in terms of handling this Pandemic. This is not surprising, given the fact that even without enough test kits, the 1.3 billion-population country is using a gigantic surveillance network to trace and quarantine infected people.

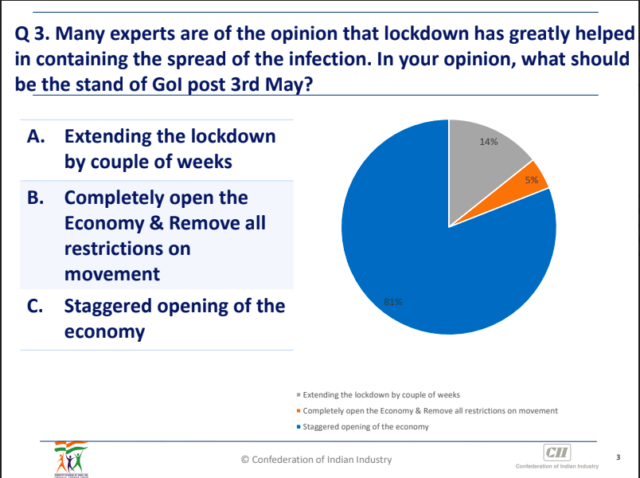

Many experts are of the opinion that lockdown has greatly helped in containing the spread of the infection.

Post the 3rd of May, more than four-fifths of the respondents were of the view that the Government of India should consider staggered opening of the economy, to put the economy back on growth track and at the same time control spread of the virus. When asked to rank pressing challenges faced by India Inc., a majority (58 per cent) of the respondents have cited liquidity crunch as their biggest concern, followed by supply chain bottlenecks and labour shortage.

Substantiating the fragile economic recovery, majority of the respondents expects significant decrease in their companies topline and bottom-line during the year, 2020 – 21. On the labour market scenario, the majority of the respondents believe that employment opportunities may contract by more than 10 per cent post lockdown, highlighting tough times ahead.

Also Read: How Wimbledon Outsmarted Everyone During The Pandemic Crisis

The most important expectation India Inc. has from the Government is support in the payment of wages to industries impacted by the lockdown, with 54 per cent of respondents expecting government support. This was followed by (32 per cent) waiver of fixed utility charges & lower interest rate as other expectations from the government. For the MSMEs, India Inc. (45 per cent) feels that cost & availability of funds is the biggest impediment to their growth during COVID times, followed by market disruption (32 per cent) and the issue of delayed payments (23 per cent).

Commenting on the Snap Poll, Mr. Nikhil Sawhney, Chairman, CII Northern Region said, “The results of this poll indicate the mood and sentiments of India Inc. The pandemic along with resultant lockdown has severely impacted the economy and livelihood of millions. The SME sector, which provides significant amount of employment opportunities, is greatly impacted by this lockdown. Government of India along with the Reserve Bank of India has announced some measures to alleviate the pain of the industry. However, we at CII believe that Indian industry requires massive stimulus from the government as has been done in other developed countries to put the economy back on growth track.”

Going ahead, all will have to work in tandem to address the issues faced by the industries and offer required assistance to trade and industry to put the economy back on track.

This Snap Poll was conducted over virtual platform, participated by 70 plus CEOs from North Indian States. The CEOs belonged to a wide range of sectors.

CII Northern Region comprise 7 States including Uttar Pradesh, Rajasthan, Delhi, Haryana, Punjab, Himachal Pradesh, Uttarakhand and 3 Union Territories – Chandigarh, Jammu & Kashmir and Ladakh.

Sources & Images: CII

Also Read:

Coronavirus To Be Beneficial To Indian Economy As 1k Foreign Firms Aim To Shift Production To India