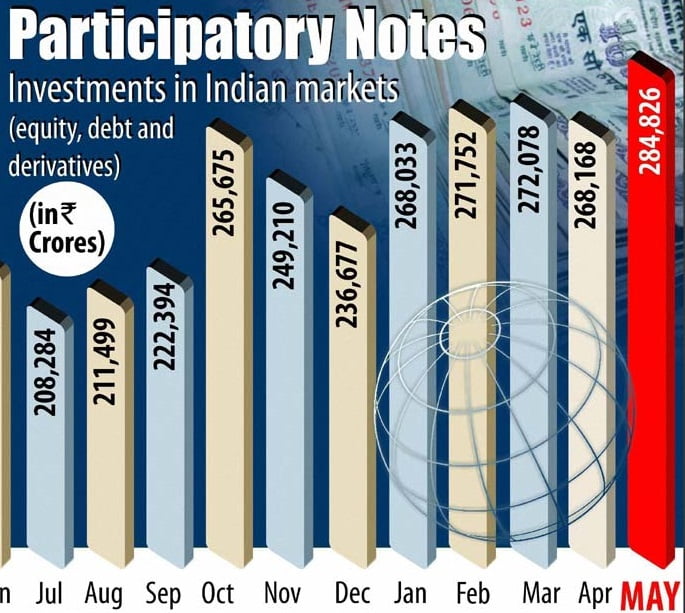

Have you ever wondered that how foreign investors and fund houses are able to invest money in Indian stocks so easily, given that S.E.B.I. is one of the most draconian capital market regulators. We keep hearing that the Indian stock market is controlled by foreign institutional investment (F.I.I.) but how?

The answer to this lies in what they call Participatory notes or P-notes through which foreign investors who aren’t registered with the S.E.B.I. (and don’t want to divulge their financial fiasco) can trade in Indian shares. Sounds like an efficient way to invest in the market without disclosing your detail or filling a registration form. But why aren’t P-notes letting SEBI chief Mr. U.K. Sinha have a good night sleep?

WHAT’S SO GOOD ABOUT THEM?

International access to the Indian capital markets is limited to foreign institutional investors (foreign institutions registered with S.E.B.I. and their national regulator).But through P-notes, the investors have devised a route to circumvent this as they allow the identity of the investor to be kept anonymous. FIIs are required to register with SEBI, but P-notes who trade through them are not.

While a common investor has to fill up several K.Y.C. (know your customer) forms, provide PAN ,a P-Note investor can invest anonymously. This makes it a legal way to route unaccounted wealth in Indian equities

HOW DOES IT WORK?

Foreign institutional investors, foreign banks and brokerages in India issue P-notes to foreign investors and invest in Indian stocks on their behalf. So let’s say that you are living in U.S.A. and after giving up on your holdings in Uncle Sam (after watching Swades), you want to burn your hot money in India. Let’s say you want to open an account in Sharekhan Ltd., Delhi. You can call them, tell them that you are unregistered and have done some shady deals in the States .They tell you to pick any stock or fund and then they bet your (black) money and in return issue P-notes confirming an offshore stock transaction.

This is an informal and opaque process where brokerages hold on to stocks for foreign investors. Any dividends or capital gains collected from the underlying securities go back to the investors.

WHERE IS THE PROBLEM IN ALL THIS?

P-notes have been controversial instruments from the start and every time the government wants to regulate them, market starts falling preventing the government to take the harsh step. The government fears that P-notes are being used as instruments for money laundering. Even listed company promoters are believed to re-route their investments in their own companies through the P-note route. This allows them to flout the stringent insider trading norms that regulate such proprietary investments.

Since P-notes are opaque and the identity of the owner is known only to the F.I.I., trading them freely makes it very difficult to find the original owner of these P-notes. Hence it can be said that the PN system is blatantly discriminatory and seems to favor ghost investors.

WHAT HAS BEEN DONE?

S.E.B.I. has proposed an increase in disclosure requirements and restricted transfer of P-Notes. Both these changes will help in keeping track of the beneficial owners of these instruments. Through its changes, S.E.B.I. aims to bring P-Note holders under the ambit of Indian anti-money laundering norms. Transfer of a P-Note will be allowed only to a pre-approved list of subscribers.

Any suspicious transaction that comes to the notice of the issuer would need to be reported to the Financial Intelligence Unit, which functions under the department of revenue.

FINAL TAKE

The new norms are there for ensuring transparency and having checks in place while dealing with P-Notes rather than weaning out potentially abused offshore trading instruments. However, the impact of tighter P-notes norms on the market is expected to be shortlived, as India is poised to grow and continue to be a bright spot for overseas market participants.

If you liked reading this, you will also like:

India And Money Laundering: Not So Clean, After All!