The one question that has been debated every year but has still been left unanswered.

Should Air India be privatized?

Air India was once considered a jewel in the Indian airline industry but now the situation is such that the government wants to give it to someone else and apparently, there is no one who wishes to buy it.

The Problem

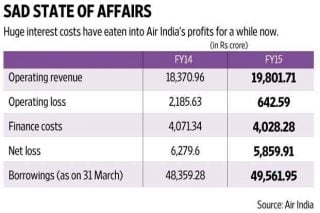

The government has been planning to break up the stake by offering 49% stake to a private owner and keep 51% to itself. There is a huge debt of Rs. 50,000 crore which consists of Rs. 28,000 crore working capital loan and Rs. 22,000 crore as aircraft loan.

Strong protest by Workers’ Union may cause a hindrance in the disinvestment process. The average age of employees is 50 years implying inefficient and low motivated staff.

Let’s discuss ways by which the whole burden of 50,000 crores can be strategically paid off.

Possible Restructuring Process

The government can strategically divest its remaining stake in Air India over a period of 5 to 7 years. The amount received from disinvestment should be first used to pay off the working capital loan to improve the operating profits of the enterprise.

The fate of the employees has been one key issue. There have been constant protests by the trade unions to not privatize Air India as it would compromise their situation.

The government is trying to adopt the following options to provide relief to the employees :

1. Staying in the enterprise with renewed terms and conditions

2. Join other Public Sector Enterprises

3. Opt for Voluntary Retirement Scheme

4. Agree to retire before their actual age of retirement

Why Would Anyone Buy Air India?

Though Air India has a lot of problems, there are a number of reasons an airline would go forward to buy it.

It is a member of the Star Alliance which is the largest global alliance giving it access to airport terminals (co-locations) of 193 countries. It has a huge fleet size of 120 aircrafts which fly to 72 Indian and 41 international destinations. Most of the planes are new (43 Airbus 320s and 15 Boeing 777s) which can fly non-stop to the U.S.A. It also owns the maximum number of aircraft hangars (33).

It is the only Indian Airliner that has its own engineering, infrastructure, ground handling, repairs & maintenance and training centers. It has prime slots of hourly departures at domestic airports due to old rights, which are preferred by business travellers. It also has flying rights to key airports such as London Heathrow and Frankfurt airports.

There are copious reasons for one to buy it. Tata seems to be leading the race and is thinking of merging Air India with Vistara (a joint venture of Tata and Singapore Airlines).

Also read: The Great Fall Of Reliance Communications

Why Would the Air India and Vistara Marriage Be a Win-Win Situation?

- Majority Control-

Tata Sons Ltd. has a majority control in Vistara in comparison to AirAsia India in which it is a minority stakeholder.

- Class Image-

Vistara also has the image of a premium airline. A merger with Air India would mean that both enterprises will have a better and improved image and will be considered premium and pride of the aviation industry.

- Benefits Of SIA-

Merger with Vistara will also allow it to use the rights of SIA (Singapore Airlines) in the international flights’ market. Both parties will also provide sufficient equity needed to revamp Air India.

- Improved Performance-

Vistara airlines are performing better in comparison to AirAsia India (another joint venture of Tata). Its operational costs are reducing giving it a leaner cost structure mainly because of low fuel prices and better load factor. Also, its losses in comparison to its revenue are falling.

Other airlines apart from IndiGo haven’t shown any strong interest.

There is no perfect solution to the ongoing problem of Air India. The marriage of Air India and Vistara seems the wisest to me. As of now, let’s wait and watch for the next step of the government.

Sources- Air India Website, LiveMint, Business Standard

Images- Economic Times, Google Images

Also read:

http://edtimes.in/2017/06/aadhaar-vs-no-aadhaar/