We would be lying if we said that demonetisation has not made our lives difficult.

It has hampered our day-to-day activities and making simple payments like tuition fees, school fees or EMI’s have become a mammoth task.

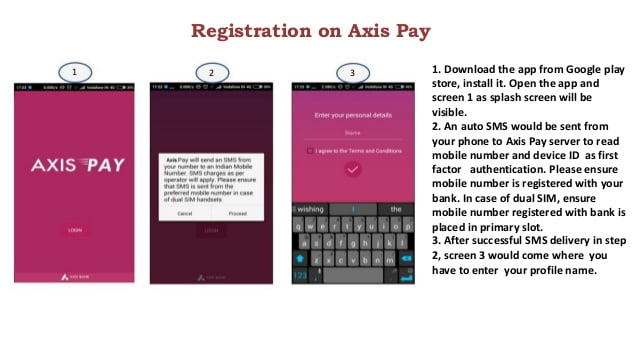

Axis Pay- Payments Made Easy

Axis Bank has launched the Axis Pay UPI App which links your bank account to make payments directly.

While mobile wallets can help you buy daily groceries, it is Axis Pay UPI App which is the key to all our problems.

Axis Pay is authorised by a leading Indian bank which makes it safer, secure and much more credible than any random application.

Axis Pay UPI App is compatible with all kinds of operating system and all one needs to do is create a unique ID and then you are good to go.

Axis Pay is based on Unified Payment Interface which is the best gift Indian banks offer!

Indian banking structure includes several public and private sector banks. It often gets complicated making payments between two different banks and since the system is so vast it takes light years to get money to move.

UPI allows you to make direct transactions between two banks without getting into messy details like IFSC code, account number and other forgettable details.

UPI is totally, 100% online.

There is no paper used. But at the same time it is totally secure. UPI transactions can only be completed when the authentication is successfully done. Authentication is based on the unique ID created by you (VPA) and you PIN number.Thus, the possibility of anybody stealing your information totally depends on how drunk you are.

Thus, the possibility of anybody stealing your information totally depends on how drunk you are.

Axis Pay Is UPI Based

Axis Pay is UPI based so Axis Pay will not only help you during this rough patch of demonetisation but later on as well.

Axis Pay removes the need to actually, physically go to a bank and make a payment.

No more cheques and no more forms need to be filled.

Mobile wallets like Paytm, Freecharge and Mobiwik charge taxes on every payment you make.

The amount may seem menial but if all overhead charges are added it becomes quite a lot of money.

Payments made through Axis Pay include no taxes so you save a lot of money.

Mobile wallets usually charge 2-4% to convert money from bank into wallet. Sender and Receiver both need to have wallets of the same app to make the exchange possible.

Since, Axis Pay is UPI based exchange is possible between any app.The cash transfer limit is Rs.1,00,000. Which other app gives you this much?

The cash transfer limit is Rs.1,00,000. Which other app gives you this much?Hence it is safe to say that Axis

Hence it is safe to say that Axis Pay is absolutely free!

Demonetisation has hit all of us but new developments like the Axis Pay UPI App are out there to make life comfortable and easier for us.

The kind of facilities provided in this app that too, at no cost is hard to get. Not taking advantage of such an app will be foolishness so be smart and use the app.

Read On:

http://edtimes.in/2016/08/some-cool-digital-banking-features-you-should-start-using-right-now/

Thank you for sharing such great information. It has help me in finding out more detail about Best Upi App .

Thank you for sharing such great information. It has help me in finding out more detail about Upi App Bank