“Hey man, I love paying taxes” said nobody ever. But I think most of us understand why taxes are important. As much as we hate them, we need the government to function otherwise bad things happen (see: Most of the Middle East)

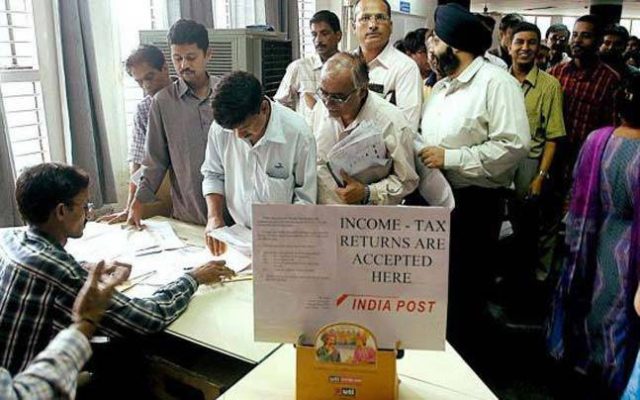

The recent push by the Modi government to come down hard on tax evaders is surreal. The demonetization debacle certainly came as a surprise to most of us. New regulations such as limiting cash transactions to Rs. 2 lakh from April 1st are incredibly refreshing.

That being said though, the proposed Finance Bill for 2017 has some serious issues that are not being properly addressed. Since I pay my taxes, I surely want everybody else to pull their weight (I suffer, you must too) but this sentiment must not be mistaken by tax officials and the “taxman” as a green light to unjustifiably and unnecessarily harass people.

This can only be ensured if the tax officials and other income tax officers have accountability, a key component that is missing from the proposed Finance Bill. Section 132 of the Income Tax Act in the Bill specifically proposes to give supplementary powers to such tax officials: not requiring them to disclose any reason for suspicion for conducting search and seizure on any tax payer.

Yeah That’s An Issue

Considering that tax officials and income tax officers do not have an outstanding track record to begin with…like this, and this, and let’s not forget this. Do I need to say anything more?

IT Officials Have a License to Ruin Lives

Harassment by IT officials is not unheard of, I bet we all have at least one story where tax officers went out of their way to make someone else’s life miserable. They already have the means to intimidate and torment hardworking people and this new provision is giving them a nuclear option: to raid your house and properties on a whim!

Reddit user /u/modfill shared one such story:

“I faced IT dept problems (survey, scrutiny, tax notices, penalties etc) for close to 10 yrs, after my dad died, IT Officers put an addition of 7 CR on my companies (Which were in about 10 crore of losses at the time and reason for my dad’s health issues & death too). In that time, they attached a property too and countless Bank Accounts/Mutual Funds/FDs/RDs etc. Ultimately, I was bullied by IT dept for close to 10 yrs, even though they knew my company went bankrupt, bank auctioned off the companies etc. I kept fighting through courts and appeals courts but till then, they squeezed and blocked every inch of every penny me or my family had. At the end of it all, We approximately paid around 1 CR (property + Seized amount + voluntary deposits)

Whatever humanity or moral grounds i had to fight were usually laughed off by IT dept and its officials. They didnt even care if we died, rather they were more interested in bribes and bullying us. Finally I got out of their stranglehold only when we won a few cases but all amounts which was to be refunded to us was adjusted in random penalties. Hence, we got nothing back even after winning the court cases.

So coming onto the new legislations will only make IT officials more hungry [sic] and more DOG-Like. The paper-reality and ground-realities in India is hugely different. IT Officials bully people a heck lot and everything goes unnoticed. And IT dept only thinks that all Money in circulation is BLACK MONEY.”

SMH

Hell in the immortal words of Uncle Ben, “With great power comes great responsibility”. Are you just going to dismiss it?

With the bill in place, you and your family better have a good health plan since you’ll need lots of stress relief medication because you refused to offer “gifts” to such tax officials and they decide to go through your finances going back to 1947. If you think it is bad now, just watch.

Ambiguities Benefit the Authorities as Usual

Not to mention (putting my tinfoil hat on), bankers and income tax officials are always colluding to expand their influence on the public and are working towards reaching a straight-up mafia like presence.

The majority of people are still reliant on old school banking and put all their trust in these financial institutions which makes it very hard for new banks to open up and de-incentivizes the well-established banks from ever changing their uncooperative and corrupt behavior.

Is this the “Digital India” that politicians have been shoving down our throats all this time? If the idea is to go after black money then why wealthy businesses are not seriously scrutinized?

Why are ordinary hard-working Indians being targeted more and more? Small business environment is heavily reliant on a liquid cash economy and demonetization has already made matters worse. How do we expect new business to thrive if we are constantly badgering them with meaningless inquiries?

Yeah sure let’s give these tyrannical egoistic maniacs more power because they have our best interests in mind.

Other Recommendations:

http://edtimes.in/2017/03/stock-market-101-investing-millennials/