The Indian loan market is expected to reach a size of I.N.R. 21,000 billion by the end of 2016 with a C.A.G.R. of over 19% over the last five years.

However I think that the lending industry hasn’t done enough. Bad loans is a big problem but it isn’t the only impediment that the R.B.I. needs to comment on. Getting a loan is a tedious procedure.

It might look simple in the bank’s advertisement, but the fact remains that there are a lot of hiccups in the entire process.

INCOMPATIBILITY BETWEEN LENDERS AND BORROWERS.

Lack of last mile connectivity and lifecycle management of the process leads to many of the loan applications not even passing the first test. It could be the age criteria, income criteria, proper documents not being submitted, the bank not being able to verify your details properly, not passing the field investigations conducted by the bank and many more.

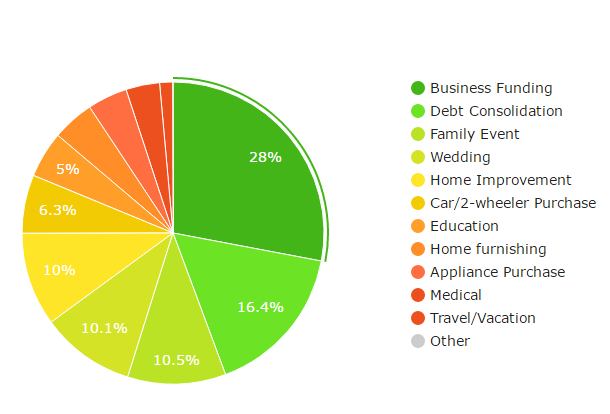

Almost 40% of the loan requirements come from small business activities and family events. Keeping proper documents ready and providing verifiable details to sail through the draconian process becomes even more difficult.

NOT GETTING THE DESIRED AMOUNT

Getting a loan depends on the repayment capacity of the borrower. Many things come into picture, when the bank decides how much loan a person can get. The monthly income, financial history, other unpaid loans with the borrower, past repayment record, credit card usage history if any, bounced checks, average balance with the banks, continuity in present employment, total years in employment etc. This combined with lack of transparency and personalization of the process makes it more difficult to get the whole amount sanctioned.

(Loan requirements in India)

(Loan requirements in India)

WE JUST CAN’T COMPARE LOANS

One of the biggest obstacles in negotiating the cheapest source of debt is that we don’t know the relevant figures to do so. Banks try to convince us that they have a scheme for the credit wise but is there any backing on the same?

There isn’t a facility of detailed comparison to counter the interest rate dilemma, no genuine advisory service on transfer charges, down payments and valuation of properties which makes us even more helpless and we end up choosing the loan whose advertisement has a more credible celebrity.

SOLUTION?

The above-mentioned problems are very common when you apply for the loan and the process starts. Thanks to upcoming online borrowing and lending platforms to help us discover effective credit solutions and bridge the gap between borrowers and lenders. Platforms like Creditnation.in are working as lead aggregators to recommend the best solution for both the parties.

Beating the system by end to end delivery and personalized advisory on loans, these online lending platforms are helping us to compare and apply for real time offers. Long-term customer relationship and in house credit appraisal have become the key to get it financed in 3-4 days without finding the nearest bank branch or falsifying documents.

Well, it’s the start of the Fintech industry which will take considerable time to get RBI’s nod and change the lending scenario.

Till then, keep expecting loan calls from your bank.

If you liked reading this, you will also like :

Financial Literacy: Key To Creating And Sustaining Wealth